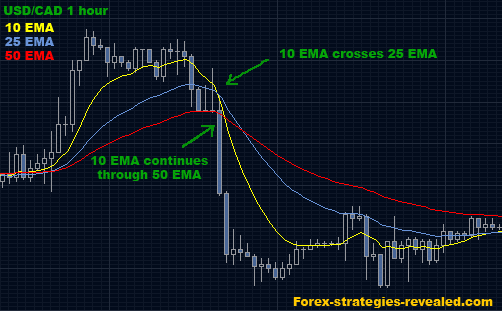

Trading systems based on fast moving averages are quite easy to follow. Let's take a look at this simple system.

Currency pairs: ANY

Time frame chart: 1 hour or 15 minute chart.

Indicators: 10 EMA, 25 EMA, 50 EMA.

Entry rules:

When 10 EMA goes through 25 EMA and continues through 50 EMA, BUY/SELL in the direction of 10 EMA once it clearly makes it through 50 EMA. (Just wait for the current price bar to close on the opposite site of 50 EMA. This waiting helps to avoid false signals).

Exit rules:

option1: exit when 10 EMA crosses 25 EMA again.

option2: exit when 10 EMA returns and touches 50 EMA (again it is suggested to wait until the current price bar after so called “touch” has been closed on the opposite side of 50 EMA).

Forex system - Fast moving averages crossover

_________________________________________________________

Advantages: it is easy to use, and it gives very good results when the market is trending, during big price break-outs and big price moves.

Disadvantages: Fast moving average indicator is a follow-up indicator or it is also called lagging indicator, which means it does not predict the future market directions, but rather reflects current situation on the market. This characteristic makes it vulnerable. First, because it can change its signals any time, second – you need to watch it all the time, third - when market trades sideways (does not trending) with very little fluctuation in price it can give many false signals, so it is not suggested to use it during such period.

----------- EDUCATION ---------

-------TRADING METHODS ------

--------- FOR TRADERS ----------

-------------- OTHER ------------

---------------------------------------------

_________________________________________________________________________________________________________________________________________